Investment Products

EQUITIES

Our equity strategies and recommendations are structured to deliver long-term, sustainable growth in client portfolios. We focus on companies with predictable growth profiles, strong competitive positioning, and top quality management, complemented with solid balance sheets, ROEs, and cash flows.

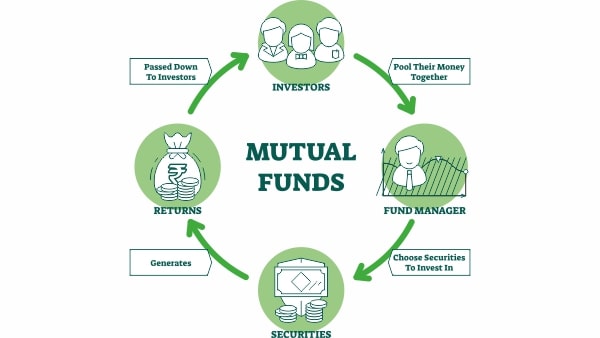

MUTUAL FUNDS

We offer a careful selection of mutual funds, based on in-depth analyses that best represent the most appropriate route-to-market for specific strategic or tactical objectives. Our analyses include firm and fund-specific factors, including consistency and risk management. We also ensure rigorous periodic monitoring to revalidate our conviction in the constituents of our selection.

DERIVATIVES

For client objectives ranging from opportunistic trading strategies to the creation of hedging based customised exposures and pay-off profiles, our derivatives desk can create tailored investment management recommendations using fundamental, quantitative, and technical tools.

FIXED INCOME

Our investment advisors monitor the global macro economic environment as well as domestic credit and monetary policy drivers to ensure client portfolios are positioned with the most optimal instruments to meet their return objectives for specified risk levels. We also monitor the fixed income markets for tactical trading opportunities to generate excess returns and for changing interest-rate, credit-curve, and duration factors.

ALTERNATIVE INVESTMENTS

We are part of the alternative investment ecosystem and are constantly evaluating opportunities within this asset class across the full range of instruments including private equity and hedge-funds. We are extremely selective about our recommendations, which are based on a rigorous due diligence process that encompasses a number of technical evaluation criteria, combined with sound macroeconomic context-setting.

STRUCTURED PRODUCTS

Our structured products team provides customised route-to-market approach for our in-house views, or hypotheses generated by you, through the judicious use of both principal-protected as well as non-principal-protected structures, across asset classes, to achieve the desired payoff profiles.